Serviços Personalizados

Artigo

Estudios Económicos

versão On-line ISSN 2525-1295

Estud. Econ. vol.29 no.58 Bahía Blanca jan. 2012

"Models as signs" as "good economic models"

Ricardo F. Crespo*

* IAE (Universidad Austral), CONICET, e.mail: rcrespo@iae.edu.ar

enviado: Junio 2012

aceptado: Agosto 2012

Resumen

En éste trabajo se aplica la teoría de los signos de Juan Poinsot para la evaluación de un "buen modelo económico". Primero se define qué se considera un buen modelo, luego se presenta el marco conceptual de Poinsot y se presentan algunas ideas actuales acerca de modelos económicos. Luego se muestra cómo se pueden combinar las ideas de Poinsot y sobre los modelos. La conclusión es que un buen modelo señala posibles causas de los fenómenos bajo estudio las que han de verificarse empíricamente.

Clasificación JEL: A11, B41, C0

Palabras clave: Modelos económicos; Teoría de los signos; Causalidad.

Abstract

This paper applies John Poinsot's doctrine about signs to the evaluation of "good economic models". First, a "good model" is defined. Then, Poinsot's conceptual framework and some current ideas about models are introduced. Third, the paper shows how Poinsot's and ideas about models can be combined. The conclusion is that a good model raises possible causes of the phenomena under examination, which should be then empirically verified.

JEL Classification: A11, B41, C0

Keywords: Economic models; Theory of signs; Causality.

INTRODUCTION

There are different kinds of models, and different explanations about their nature, their role and about the way of building them. This topic has been recently extensively explored by philosophers of economics reaching at varied positions. Indeed, models are considered as methods for the investigation of stable real causes (Cartwright 1999), but also as mediators between theory and data (Haavelmo 1944, Morrison and Morgan 1999), as surrogate systems (Mäki 2011), as vehicles for testing theories, as thought experiments, as conceptual explorations (Hausman 1992), as open formula or frameworks for formulating hypotheses (Alexandrova 2008: 200; Guala 2005: Chapter 7), as "credible worlds" (Sugden 2000 and 2009), as means of communication or telling stories (Dow 2002: 96-8, Morgan 1999: 178ff.), as "epistemic warfare" (Magnani 2012) or as analogies (Hesse 1966, McMullin 1968). These positions are more or less realists, in the sense of attempting or not to explain and capture some truth about the phenomena examined.1

Models can be theoretical or empirical, they can be aimed at merely describe a phenomenon or at explaining it. I think that economists -however not all of them- are greatly realists: they want to capture some truth about reality because they are conscious that truth is relevant for the accuracy of economic policies. I consider that there is an implicit agreement among social scientists about what makes a "good model." Through Internet research, interviews with colleagues and ideas taken from academic papers I have arrived at the characterization of a good model which I will convey here2. A good theoretical model brings to light some aspects of reality previously unproved or unnoticed. The conclusions of a good empirical model should coincide with the available data about the concerned situation. Sam Ouliaris (2011) has recently asked and asserted in a publication of the IMF under the section "back to basics":

What makes a good economic model? Irrespective of the approach, the scientific method (lots of sciences, such as physics and meteorology, create models) requires that every model yield precise and verifiable implications about the economic phenomena it is trying to explain. Formal evaluation involves testing the model's key implications and assessing its ability to reproduce stylized facts. Economists use many tools to test their models, including case studies, lab-based experimental studies, and statistics. (...) No economic model can be a perfect description of reality. But the very process of constructing, testing, and revising models forces economists and policymakers to tighten their views about how an economy works.

Paul Teller (2009, p. 235) asserts that "science accomplishes veridical accounts through the use of models", but he clarifies that we accept a statement as true when it is "true enough", relative to our needs and interests (p. 236). Then, when speaking of good modes it is essential to maintain a balance between the model's link with reality and the necessary simplification (isolation and idealization) in order to focus on specific dimensions or aspects of reality.

In this paper I will suggest to apply a conceptual instrument, i.e., a specific conception of signs, for assessing whether a model is a good model. I will base the proposal in the realist conception of signs of an ancient and today rather unknown Portuguese thinker, Joannes Poinsot (1589-1644), who wrote a Tractatus de signis (Treatise on Signs). Poinsot, also known as John of St. Thomas, was one the most important representatives of the so-called Conimbricenses (from Coimbra, Portugal), a school of 17th Century logicians that developed a highly elaborated theory of signs. Let us remind that in medieval times a very rich theory of semiotics has been expounded (see Meier-Oeser 2003).

MODELS AS SIGNS

R. I. G. Hughes, for example, points to the importance that models maintain a connection with reality when he asserts that "the characteristic -perhaps the only characteristic- that all theoretical models have in common is that they provide representation of parts of the world, or of the world as we describe it" (1997, p. S325). On the other hand, Joan Robinson (as many others) points to the balance between realism and simplification when she remarks (1971, p. 141):

It is easy enough to make models on stated assumptions. The difficulty is to find the assumptions that are relevant to reality. The art is to set up a scheme that simplifies the problem as to make it manageable without eliminating the essential character of the actual situation on which it is intended to throw light.

Keynes' passage about models taken from his July 4, 1938 letter to Harrod is very well known. His concern was to detect the causes of changes in particular situations. He asserts: "Economics is a science of thinking in terms of models joined to the art of choosing models which are relevant to the contemporary world.... The object of a model is to segregate the semi-permanent or relatively constant factors from those which are transitory or fluctuating so as to develop a logical way of thinking about the latter" (1973, pp. 296-297). For him, models are "instruments of thought" (1973, p. 299) highly adapted to the target situation by an intimate acquaintance to the facts that it intends to explain. That is, a model makes reference to realities in a specific way.

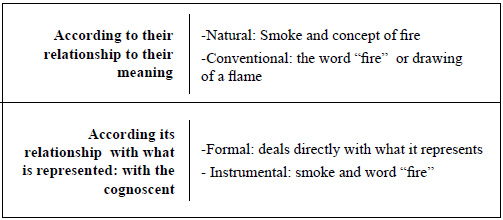

At this point, I wish to introduce Poinsot's doctrine about signs. For him, a sign is "that which represents something other than itself to a cognitive power" (1985, p. 25). He thus classifies signs in this way (1985, p. 27):

[I]nsofar as signs are ordered to a [knowing] power, they are divided into formal and instrumental signs; but insofar as signs are ordered to something signified, they are divided according to the cause of that ordering into natural and stipulative and customary. A formal sign is the formal awareness which represents of itself, not by means of another. An instrumental sign is one that represents something other than itself from a pre-existing cognition of itself as an object, as the footprint of an ox represents an ox. And this definition is usually given for signs generally. A natural sign is one that represents from the nature of a thing, independently of any stipulation and custom whatever, and so it represents the same for all, as smoke signifies a fire burning. A stipulated sign is one that represents something owing to an imposition by the will of a community, like the linguistic expression "man." A customary sign is one that represents from use alone without any public imposition, as napkins upon the table signify a meal.

The following table will clarify this classification:

Table 1- Poinsot's Classification of Symbols

According to Poinsot's conception, words (as "fire") are considered instrumental and customary or conventional signs, while thoughts or concepts (as the concept of fire) are formal and natural signs of the apprehended reality. Poinsot's formal sign directly remits to a real reference. Leo Apostel (1961, p. 15) asserts that "the mind needs in one act to have an overview of the essential characteristics of a domain." This is performed by a "formal sign".

This conceptual framework is in accordance with some current ideas about models. Uskali Mäki (2011) distinguishes between the model ("the imagined world, possessing the characteristics provided by the set of idealizing assumptions and missing characteristics of real world situations") and the description of the model (mathematic, verbal, geometric). In the same vein, Pierre Salmon (2000 and 2005) distinguishes between:

- the real world with all its complexity;

- the isolated or "target system" (i.e., the aspect of the real world, isolated from its context, that we try to explain and understand);

- the model or "model described"; and

- the description of the model or "describer model".

An additional step in the assessing or building of a good model would be that the "describer model" actually serves as an instrumental and customary representation or sign, and the "model described" as a formal and natural sign of the real connections between the variables of the isolated target system.

If we accept the last step proposed for building a good model, the described model should bring the knower to the real connections concerned in a way that allows him to understand them directly. We do not need to fix our attention on the model per se but rather directly grasp the relation of concepts that it expresses. In this way, knowledge "passes through models" towards the known relation. For example, using a golf metaphor, a good stroke highly depends on continuing the swing down with a good "follow through." Just as if you stop the swing at the ball the stroke is ineffective, if knowledge stopped at the model itself, it would be ineffective as well.

One may ask, however, whether the belief in this relation is true, i.e., whether it is strictly speaking knowledge3. This is one of the characteristic of my vision of a "good model". Models, however, are fallible. As such, their truth depends on the empirical existence of the concepts that they denote united by the relation that they postulate. In other words, are the concepts denoted by the model actually related in the way expressed by the model? If the answer is affirmative the model is true. The aim of scientific inquiry is to determine the truth of the model. Consequently, to prove that a model is a "good model" we need to have access to the information required to confirm it. Obviously, if the model is a theoretical model we need to derive empirical propositions that can be verified with existing data.

Finally, what is the kind of relation expressed by a "good model"? At the beginning of the paper I asserted that most economists are realists. However, I have to recognize that some economists only aim to know which variables are "determined" (and hence "explained" but not necessarily really caused) by the model and which not. In fact, they usually do not need more than this and it is sufficiently useful for provide an explanation and predict. However, I maintain that a "good model" is not satisfied with only knowing which variables are determined, but that it aims at knowing the real causes acting at play in the situation under analysis. Why? Because, as it is very well known, correlation without causation makes for very imperfect knowledge and economists want to accurately predict and to propose trustable economic policies.

The quest to discover causes is as old as Aristotle. He states: "Plainly we are seeking the cause. And this is the essence (...) which in some cases is the end (...) and in some cases is the first mover" (Metaphysics VII, 17 1041a 27-30; see 1041b 10ff.). He also asserts: "We suppose ourselves to possess scientific knowledge of a thing, as opposed to knowing in the accidental way in which the sophist knows, when we think that we know the cause on which the fact depends" (Posterior Analytics I, 2, 71b 8-11). Also nowadays there is a growing current in the philosophy of science holding that scientific explanation must be causal explanation (see, e.g., Nancy Cartwright 1989, Jim Woodward 1989). Specifically, for example, Cartwright (2009, p. 20) asserts: "the function of a model is to demonstrate the reality of a capacity" (for her, a capacity is a stable cause).

For Henry Veatch a scientific hypothesis "leads to a recognition of a causal order underlying and making intelligible the connections between the various objects of knowledge" (1952: 330). For him, these hypotheses "would seem to be instruments for intending the causal order and structure of what is given in experience" (1952: 331). I indeed think that this is what economists should look for in models. Specifically, for example, Larry Boland (1989, Chapter 6 and 2009) claims that "every model can be seen to be positing a causal mapping." This is the describer model. He adds that "every explanation of observed events (...) implies a conjectured cause-effect relationship" (2010, p. 536). The simplification that a "good model" entails should be then aimed at detecting the relevant causes. Caterina Marchionni suggests that "some of the unrealistic elements of economic models serve the function of fixing the causal background" (2006, p. 426).

Do we need that all models reveal causes? Not all the types of models need to reveal causation. Beyond all the possible kinds of models, however, there is a reason why the social field suggests the quest of causes. Whatever conception we hold about the connection of events within the social field, i.e., teleological connections, reasons for action, intentional causation (Searle 2001), there is a growing agreement about what in ordinary language we would call "cause". This is why it seems that to express or reveal a cause, however not being a necessary condition, is a sufficient and convenient condition of good models. It is opportune to hear actual economists. For example, Kindleberger asserts (1965: 40):

An economic model is a statement of relationships among economic variables. Its purpose is to illustrate causal relations among critical variables in the real world, stripped of irrelevant complexity, for the sake of obtaining a clearer understanding of how the economy operates, and in some formulations, in order to manipulate it.

The verbs "to operate", and "to manipulate" actually refers to causes4. A good model that reveals the causes is good for explanation, for prediction and for policy. I recognize that this leaves some problems up for discussion: the definition and classification of causes; how to recognize and measure them; as well as the existence, the stability, and knowledge of social causes (see, e.g., John Hicks 1979, Cartwright 2007). However, we may broadly maintain that a "good model" should postulate a hypothesis about the causes at work in the analyzed situation. Perhaps Anna Alexandrova (2008, p. 396) proposal of models as "open formulae" is too weak, but it is close to my idea. She proposes that "models are used as suggestions for developing causal hypotheses that can be tested by an experiment. I would say that "good models" postulate testable causal hypotheses.

Then, we need to prove this hypothesis. We must take into account that given the local and contingent character of the social field we may easily make mistakes. In fact, there is a tradeoff between precision and accuracy (see Paul Teller 2008). We must then perform an empirical verification. As Aristotle asserts in Generation of Animals (concerning his observations about the generation of bees) "credit must be given rather to observation than to theories, and to theories only if what they affirm agrees with the observed facts" (III 10, 760b 31). Through testing, we carry out a process of adapting models to the specific situations concerned. As Keynes maintains, "the specialist in the manufacture of models will not be successful unless he is constantly correcting his judgment by intimate and messy acquaintance with the facts to which his model has to be applied" (Keynes 1973: 300).

Harold Kincaid (2008, pp. 596-7, cursive in the original) explains,

If we have evidence that a model with unrealistic assumptions is picking out the causes of certain effects, then we can to that extent use it to explain, despite the "irrealism." If I can show that my insight is that a particular causal process is operative, then I am doing more than reporting a warm feeling. If I can show that the same causal process is behind different phenomena, then unification is grounded in reality. If I can provide evidence that I use my model as an instrument because it allows me to describe real causes, I can have confidence in it. Finally, if I can show that the causes postulated in the model are operative in the world, I can begin to provide evidence that the model really does explain.

The term "insight" used by Kincaid is often used by Keynes referring to the intellectual apprehension (see my paper 2008). It is also used by Kuipers (1961, p. 132): "Senses and intellect both play an active part in our shaping of the model and consequently in our obtaining an insight into the phenomena which cause us to try and find explanations" (my cursive). "Good models" produce an intellectual apprehension of or insight into a possible cause.

In sum, though they do so fallibly, models should identify causes in order to apprehend them. They need to be fine tuned through a process of verification. Although I recognize that data are theory-laden and value-laden, I maintain that to "test, test and test" (D. Hendry 1980: 403) is the only way of refining the apprehension of cause.

Notas

1 I am referring not to scientific realism but to epistemic realism, the position holding that "the Xs that are claimed to exist are also knowable. Different forms of epistemological realism presuppose some versions of ontological realism and semantic realism and add to them the idea of being known or being knowable. Epistemological realism says of some existing X that facts about X are known or can be known, implying that knowers have epistemic access to X, that there is no veil separating the cognitive subject and the existing object" (Mäki 1998, p. 407). Concerning "phenomena" I adopt James Woodward and James Bogen's concept. For them (see Bogen and Woodward 1988 and Woodward 1989: 393) phenomena are stable and general features of the world that are beyond data, and that can be explained and predicted by general theories. Theories, for them, are not about data, but about phenomena. Phenomena, explains Bogen (2009), are processes, causal factors, effects, facts, regularities and other pieces of ontological furniture. This implies that knowledge goes beyond observation; observations only help us arrive at the knowledge of those kinds of phenomena, a theoretical reason's knowledge.

2 I found the following kinds of assertions about "good models" on the web (www.google.com): "Having a good model is synonym of having a low representational gap" (http://www.makinggoodsoftware.com/2010/05/17/how-to-create-a-good-domain-model-top-10-advices/). "A good model has to be as close to the real system as possible; at the same time, it should not be too difficult or complicated to use for analyzing the behavior of the system. That means, a good model should be realistic enough so that the results of the model can give a fairly realistic description of how the system would behave under certain changes. At the same time, a good model should also be easy to use." (http://www.soi.wide.ad.jp/class/20070042/slides/08/6.html). For Frits Vaandrager, (Radboud University Nijmegen) a good model has a clearly specified object of modeling and purpose, is traceable, is truthful, simple, extensible and reusable (http://www.cs.ru.nl/~fvaan/PV/what_is_a_good_model.html).

3 According to a longstanding philosophical tradition, knowledge is by definition a true belief. From the days of Plato to the present, knowledge is, for most scholars, justified true belief.( See, for example, R. K. Shope, "Propositional Knowledge", in J. Dancy and E. Sosa (1992), A Companion to Epistemology, Oxford: Blackwell, or M. Steup, "The Analysis of Knowledge", in Stanford Encyclopedia of Philosophy, //plato.Stanford.edu/entries/knowledge-analysis/.) Thus, the least we can assign to knowledge is to be 'factive' (to presuppose the truth), i.e., if we know that p, then it is the case that p. We cannot know something that is not in fact. This does not portray our intelligence as infallible. If the known proposition is not true, an epistemic state of mere belief will emerge, different from an epistemic state of knowledge. Keynes asserts: "Thus knowledge of a proposition always corresponds to certainty of rational belief in it and at the same time to actual truth in the proposition itself. We cannot know a proposition unless it is in fact true" ([1921] 1973, p. 11). Closer to Keynes than Plato or contemporary philosophers, Bertrand Russell affirms: "[S]ome propositions are true and some false, just as some roses are red and some white; that belief is a certain attitude towards propositions, which is called knowledge when they are true, error when they are false" (1904: 523).

4 They might be added to the ordinary language words expressing causal concepts listed by Elizabeth Anscombe (1971: 93).

REFERENCES

1. Alexandrova, A., (2008), "Making Models Count", Philosophy of Science, 75, pp. 383-404.

2. Anscombe, G. E. M., (1971), "Causality and Determination", reprinted in E. Sosa and M. Tooley (eds.) Causation, Oxford, Oxford University Press, pp. 88-104.

3. Apostel, L., (1961), "Towards the Formal Study of Models in the Non-formal Sciences", in Hans Freudenthal (ed.), The Concept and the Role of the Model in Mathematics and Natural and Social Sciences, Dordrecht, D. Reidel Pub., pp. 1-37.

4. Aristotle, On the Generation of Animals, translated by Arthur Platt, Oxford, Oxford University Press.

5. Bogen, J., (2009), "'Saving the Phenomena' and Saving the Phenomena",http://philsci-archive.pitt.edu/archive/00004554/01/Sumitted_ 'Saving'-Saving.doc

6. Bogen, J. and J. Woodward, (1988), "Saving the Phenomena", The Philosophical Review 97/3, pp. 303-352.

7. Boland, L., (1989), The Methodology of Economic Model Building: Method after Samuelson, London, Routledge.

8. Boland, L., (2010)., "Cartwright on 'Economics'", Philosophy of the Social Sciences 40/3, pp. 530-538.

9. Cartwright, N. C., (2009), "If no capacities, no credible worlds. But can models reveal capacities?", Erkenntnis, 70, pp. 45-58.

10. Cartwright, N. C., (2007), Hunting Causes and Using Them, Cambridge, Cambridge University Press.

11. Cartwright, N. C., (1999), The Dappled World. A Study of the Boundaries of Science, Cambridge, Cambridge University Press.

12. Cartwright, N. C., (1989), Nature's Capacities and Their Measurement, Oxford, Oxford University Press.

13. Dow, S., (2002), Economic Methodology: An Inquiry, Oxford, Oxford University Press.

14. Guala, F., (2005), The Methodology of Experimental Economics, Cambridge, Cambridge University Press.

15. Haavelmo, T. M., (1944), "The Probablity Approach in Econometrics", Econometrica, 12 (Supplement), pp. i-viii, 1-118.

16. Hausman, D. M., (1992), The Inexact and Separate Science of Economics. Cambridge, New York, Melbourne: Cambridge University Press.

17. Hendry, D. F., (1980), "Econometrics-Alchemy or Science?," Economica, 47 (188), pp. 387-406.

18. Hesse, M, (1966, Models and Analogies in Science, Notre Dame, Notre Dame University Press.

19. Hicks, J., (1979), Causality in Economics, Oxford, Basil Blackwell.

20. Hughes, R. I. G., (1997), "Models and Representation", Philosophy of Science, 64, pp. S325-S336.

21. Keynes, J. M., ([1921] 1973), A Treatise on Probability, The Collected Writings of John Maynard Keynesa, London, MacMillan.

22. Keynes, J. M., (1973), The General Theory and After: Part II. Defence and Development, The Collected Writings of John Maynard Keynes, Volume XIV, London, MacMillan.

23. Kincaid, H., (2008), "Social Sciences", in Stathis Pasillos and Martin Curd (eds.), The Routledge Companion to Philosophy of Science, London and New York, Routledge, pp. 594-604.

24. Kindleberger, C. P., (1965), Economic Development, second edition, New York, McGraw-Hill Book Company.

25. Kuipers, A. (1961), "Model and Insight", in Hans Freudenthal (ed.), The Concept and the Role of the Model in Mathematics and Natural and Social Sciences, Dordrecht, D. Reidel Pub., pp. 125-132.

26. Magnani, L., (2012), "Scientific Models Are Not Fictions. Model-Based Science as Epistemic Warfare", in L. Magnani and P. Li (Eds.), Philosophy and Cognitive Science, SAPERE 2, pp. 1-38, http://unipv.academia.edu/LorenzoMagnani/Papers/1522227/L._Magnani_2012_Scientific_Models_Are_Not_Fictions._Model-Based_Science_as_Epistemic_Warfare

27. Mäki, U. (1998). "Realism" and "Realisticness," in John B. Davis, D. Wade Hands, Uskali Mäki (eds.), The Handbook of Economic Methodology, Cheltenham-Northampton, Elgar, pp. 404-13.

28. Mäki, U., (2011). "Models and the locus of their truth", Synthese 180, pp. 47-63.

29. Marchionni, C., (2006), "Contrastive explanation and unrealistic models: The case of the new economic geography", Journal of Economic Methodology, 13/4, pp. 425-446.

30. McMullin, E., (1968), "What Do Physical Models Tell Us?", in B. van Rootselaar and J. F. Staal, Logic, Methodology and Philosophy of Science III, Amsterdam, North Holland, pp. 385-396.

31. Meier-Oeser,S. (2003), Medieval Semiotics, Stanford Enciclopedia of Philosophy, http://plato.stanford.edu/entries/semiotics-medieval/.

32. Morgan, M., (1999), "Models, stories, and the economic world", in Uskali Mäki, Fact and Fiction in Economics, Cambridge, Cambridge University Press, pp. 178-201.

33. Morrison, M. and Morgan, M., (1999). "Introduction", in Mary Morgan and Margaret Morrison (eds.), Models as Mediators, Cambridge, Cambridge University Press, pp. 1-9.

34. Ouliaris, S., (2011), "What Are Economic Models?", Finance & Development, June 2011, 48/2, (http://www.imf.org/external/pubs/ft/fandd/2011/06/basics.htm).

35. Poinsot, J., ([1631-35] 1985), Tractatus de Signis. The Semiotic of John Poinsot, edited by John N. Deely, Berkeley and Los Angeles, California, London, University of California Press.

36. Robinson, J., (1971), Economic Heresies, London, MacMillan.

37. Russell, B., (1904), "Meinong's Theory of Complexes and Assumptions (III), Mind, NS, 13/52, pp. 509-24.

38. Salmon, P. (2000). "Modèles et mécanismes en économie: essai de clarification de leurs rélations", Revue de Philosophie Economique, 1/1.

39. Salmon, P., (2005). "Qu'est-ce qui représente quoi ? Réflexions sur la nature et le rôle des modèles en économie", Université de Bourgogne, Document de travail 07/2005, http://www.u-bourgogne.fr/leg/documents-de-travail/e2005-07.pdf.

40. Searle, J. R., (2001), Rationality in Action, Cambridge (Mass.), The MIT Press.

41. Sugden, R., (2000), "Credible Worlds: The Status of Theoretical models in Economics", Journal of Economic Methodology, 7, pp. 1-31.

42. Sugden, R., (2009), "Credible Worlds, Capacities and Mechanisms", Erkenntnis, 70, pp. 3-27.

43. Teller, P., (2008), "Representation in Science", in Stathis Psillos and Martin Cud (eds.), The Routledge Companion to Philosophy of Science, London and New York, Routledge, pp. 435-441

44. Teller, P. (2009). "Fictions, Fictionalization, and Truth in Science", in Mauricio Suárez (ed.), Fictions in Science, London, Routledge, pp. 235-247.

45. Veatch, H. B., (1952), Intentional Logic, New Haven, Yale University Press and London, Oxford University Press.

46. Woodward, J., (1989), "Data and Phenomena", Synthese 79/3, pp. 393-472.